The Securities and Exchange Board of India (SEBI) has introduced a new framework for the intraday monitoring of position limits in index derivatives, aiming to improve market stability and risk management. This framework mandates that stock exchanges conduct real-time surveillance of trading activity to prevent traders from exceeding prescribed position limits.

Key Highlights of the Framework

-

- Intraday Monitoring System:

- Previously, position limits were monitored at the end of the trading day. Under the new rules, exchanges will track positions in real-time throughout the day.

- If a trader breaches limits, corrective actions, including position squaring-off, will be triggered.

- Intraday Monitoring System:

- Position Limit Calculation:

-

-

- Limits will be based on a delta-adjusted methodology, ensuring accurate tracking of exposure in index derivatives.

- The framework applies to index futures and index options across all trading members.

-

- Immediate Corrective Measures:

-

-

- If a trader exceeds limits, brokers must promptly ensure compliance.

- Exchanges will issue real-time alerts, and positions must be reduced immediately.

-

- Deferred Penalty Implementation:

-

-

- Initially, SEBI will focus on compliance without imposing penalties.

- After a transition period, financial penalties will be introduced for non-compliance.

-

- Market Impact:

-

-

- The new framework enhances risk management and prevents excessive speculative trading.

- It is expected to reduce market volatility by discouraging large intraday speculative positions.

-

- Obligations for Market Participants:

-

- Brokers and trading members must upgrade their risk management systems to comply with the new monitoring mechanism.

- Institutional investors, hedge funds, and proprietary traders need to adjust their trading strategies to avoid breaches.

Conclusion

SEBI’s intraday monitoring framework marks a significant regulatory shift, ensuring that derivative trading remains within predefined risk limits. By tracking exposure in real-time, the regulator aims to protect market integrity and enhance investor confidence. While immediate penalties are deferred, compliance is mandatory, and market participants must prepare for stricter enforcement in the future. This move aligns with SEBI’s broader goal of strengthening India’s capital markets through enhanced surveillance and governance.

Latest News, Analysis & Trends

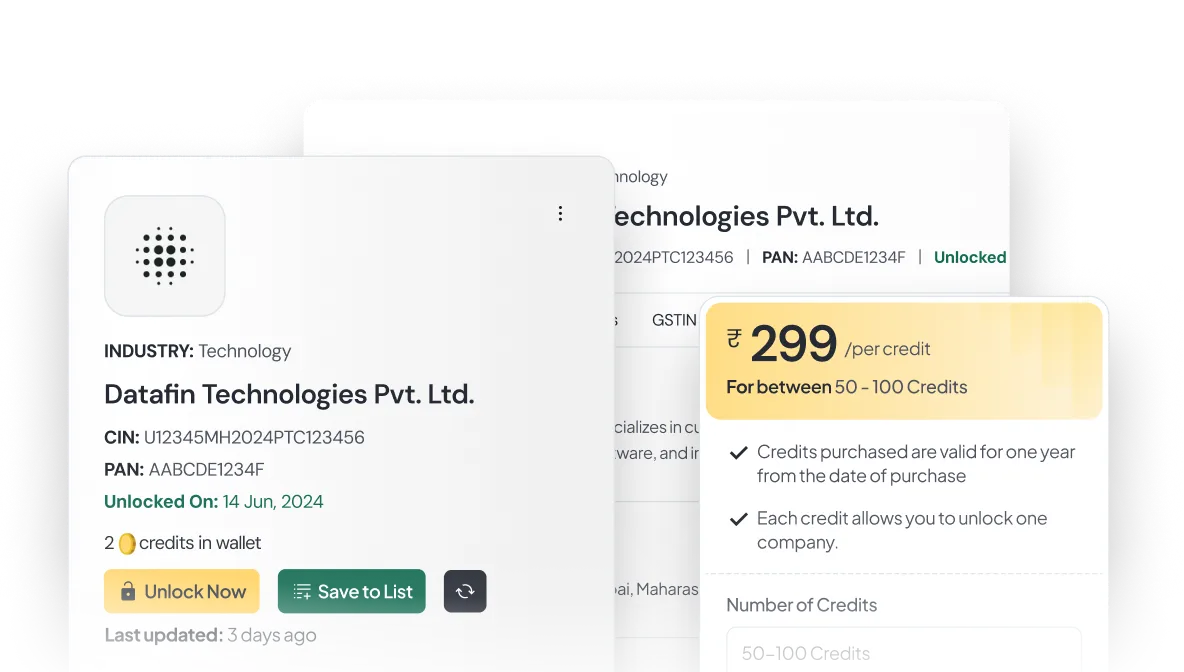

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

Access Reliable Financial Data Instantly. Explore in-depth reports, track industry trends, and gain a competitive edge. Start now and transform your business strategy with data you can trust.

Get Started Now!