Revised Norms for Government Guaranteed Security Receipts (SRs)

The Reserve Bank of India (RBI) has introduced revised prudential norms for Security Receipts (SRs) guaranteed by the Government of India under the Master Direction on Transfer of Loan Exposures, 2021 (MD-TLE). These changes aim to differentiate the treatment of government-backed SRs from other SRs, ensuring a more structured and transparent valuation process.

Key Revisions in Prudential Treatment

- Reversal of Excess Provision: If a loan is transferred to an Asset Reconstruction Company (ARC) at a price exceeding its Net Book Value (NBV), the lender can reverse the excess provision to the Profit and Loss Account in the year of transfer. However, if the sale consideration includes SRs, the non-cash component must be deducted from Common Equity Tier 1 (CET 1) capital, and no dividends can be distributed from this component.

- Valuation Based on NAV: Government-backed SRs must be valued periodically based on the Net Asset Value (NAV) declared by the ARC, which is determined by the recovery ratings. Unrealized gains from fair valuation must be deducted from CET 1 capital, and no dividends can be distributed from such gains.

- Valuation of SRs After Guarantee Expiry: Any SRs still outstanding after the final settlement of the government guarantee or upon expiry of the guarantee period will be valued at ₹1.

- Treatment of Converted SRs: If SRs are converted into other financial instruments as part of the resolution process, the valuation and provisioning will follow the norms outlined in the Prudential Framework for Resolution of Stressed Assets (dated June 7, 2019).

Immediate Implementation

The revised guidelines apply immediately to both existing and future investments in government-guaranteed SRs during the period of government backing. These changes have been formally added as paragraphs 76A and 77B in the MD-TLE, ensuring regulatory clarity.

Impact on Financial Institutions

These revisions provide a clear valuation framework for SRs with sovereign backing while ensuring conservative capital treatment to safeguard financial stability. Banks and financial institutions holding such SRs must now adopt the updated valuation and provisioning methods to comply with the revised norms.

By introducing these changes, the RBI aims to promote transparent accounting practices and ensure that financial institutions recognize risk appropriately in their capital structures.

Latest News, Analysis & Trends

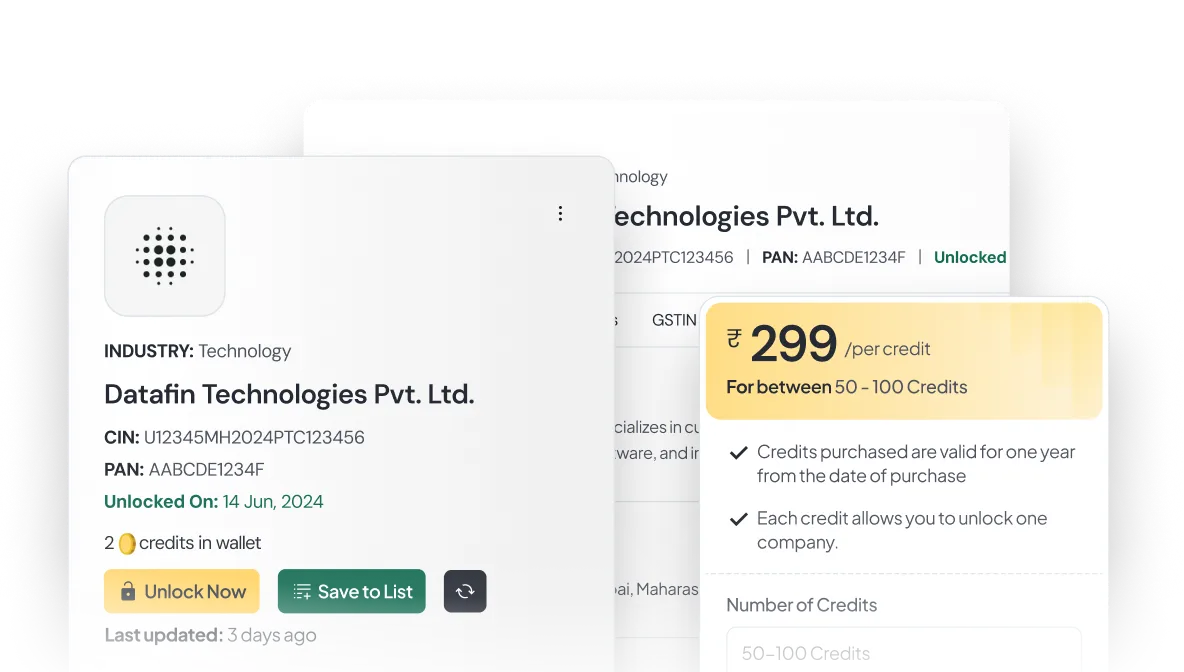

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

Access Reliable Financial Data Instantly. Explore in-depth reports, track industry trends, and gain a competitive edge. Start now and transform your business strategy with data you can trust.

Get Started Now!