Vaibhav Chaudhary

Vaibhav Chaudhary

For the first time in awhile, early-stage venture performance (which AngelList defines as activity rate and positive activity rate) trended in a positive direction in 3Q23. Activity rate, in particular, returned to levels more in-line with historical norms, while positive activity (i.e., markups), increased modestly—likely due to the increase in investor demand.

This increase in investor demand was reflected in the median valuations of startups that raised on AngelList in 3Q23, which increased across most stages after several quarters of decline. Our data also revealed an unprecedented level of demand for AI / ML startups in 3Q23. Investments into these startups are likely responsible for many of the positive performance trends we observed in 3Q23.

While 3Q23 was a step in the right direction for the early-stage startup ecosystem, it’s worth noting that 3Q23 was by no means a “good” quarter for early-stage startups. For context, this past quarter’s performance was roughly on par with 3Q22 (which, at the time, we referred to as a “downward spiral”) and the pandemic panic of 2Q20. However, coming on the heels of a quarter we dubbed the “worst quarter ever” for early-stage startups, the positive developments observed this quarter offer reason for cautious optimism amongst founders.

This quarter, for the first time ever, we partnered with the finance automation platform Ramp to share their proprietary data on startup spending activity. Taken together, our combined datasets offer unprecedented and timely access into how capital flowed into and out of startups in 3Q23. Key datapoints in this quarter’s report include:

This increase in investor demand was reflected in the median valuations of startups that raised on AngelList in 3Q23, which increased across most stages after several quarters of decline. Our data also revealed an unprecedented level of demand for AI / ML startups in 3Q23. Investments into these startups are likely responsible for many of the positive performance trends we observed in 3Q23.

Latest News, Analysis & Trends

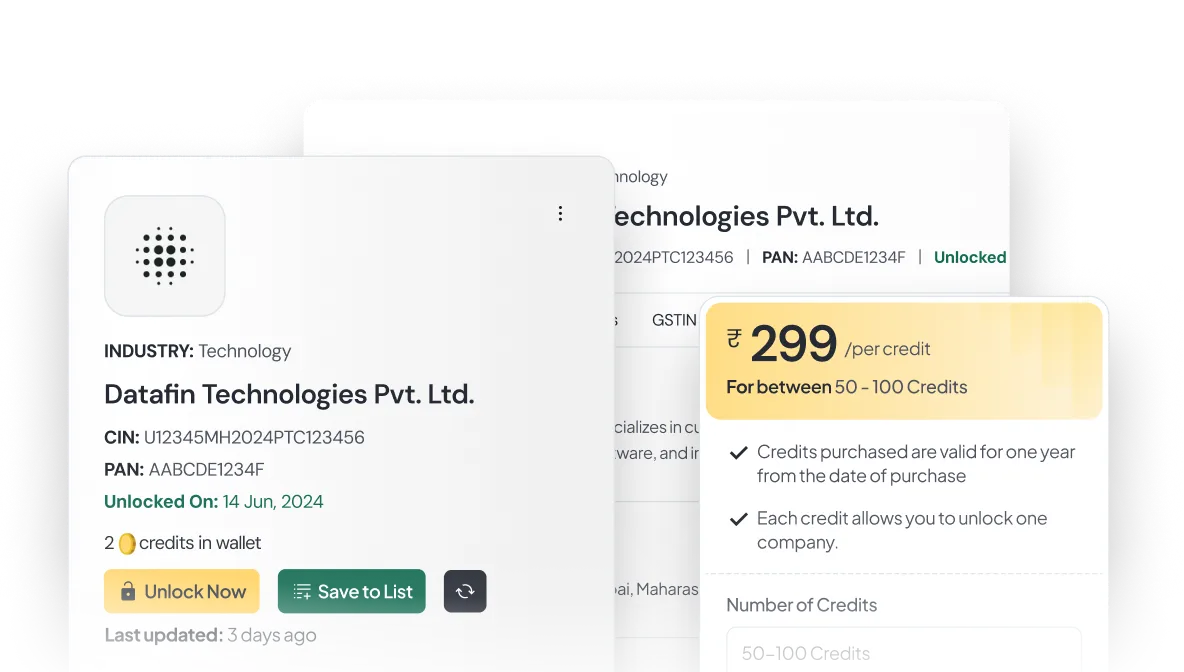

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

Access Reliable Financial Data Instantly. Explore in-depth reports, track industry trends, and gain a competitive edge. Start now and transform your business strategy with data you can trust.

Get Started Now!