As technology continues to reshape industries at a rapid pace, businesses are seeking more sophisticated and holistic approaches to credit risk assessment. By integrating advanced techniques and diverse data sources, companies can gain deeper insights into an individual’s or a business’s financial health and future potential.

In this blog, we will explore cutting-edge strategies for effective financial risk analysis and risk management in today’s evolving landscape.

Leveraging Advanced Credit Risk Assessment Techniques

To enhance the accuracy of credit evaluations, financial institutions are increasingly adopting advanced risk assessment techniques that go beyond traditional data points.

1. Alternative Data Sources:

Incorporating non-traditional data, such as social media activity and detailed payment histories, offers deeper insights into a borrower’s behavior and reliability. Analyzing social media interactions can reveal patterns indicative of financial stability or distress, while comprehensive payment histories, including utilities and rent, provide a more nuanced view of creditworthiness.

2. Behavioral & Transactional Analysis:

Examining a borrower’s spending habits, transaction frequencies, and other behavioral data helps predict future credit risk more effectively. Machine learning models can detect subtle patterns in transactional data that may indicate potential default risks, enabling lenders to make more informed decisions. For instance, sudden changes in spending behavior or transaction anomalies can serve as early warning signals of financial instability.

3. Network-Based Risk Assessment:

Evaluating a borrower’s financial connections, such as business partnerships, supplier relationships, and shared financial ties, can provide a broader perspective on risk. Advanced network analysis tools assess how an individual or business is positioned within an economic ecosystem, identifying indirect risk factors that traditional assessments might overlook. For example, a company heavily reliant on financially unstable suppliers may face higher credit risk.

Role of Financial Ratios in Credit Evaluation

Financial ratios remain fundamental tools in assessing a company’s financial health and creditworthiness. Key ratios include:

1. Debt-to-Equity Ratio:

This ratio compares a company’s total liabilities to its shareholder equity, providing insights into its leverage and financial structure. A higher debt-to-equity ratio may indicate greater financial risk as the company relies more heavily on borrowed funds. Conversely, a lower ratio suggests a more conservative approach to financing and potentially lower risk.

2. Interest Coverage Ratio:

This ratio measures a company’s ability to meet its interest obligations from its earnings before interest and taxes (EBIT). A higher interest coverage ratio indicates that the company comfortably covers its interest payments, reflecting financial stability. On the other hand, a lower ratio may signal potential difficulties in meeting debt obligations.

The Significance of Technology in Credit Risk Assessment

The integration of technology, particularly artificial intelligence (AI) and machine learning, is transforming credit risk assessment.

1. AI-Driven Predictive Analytics:

Using AI in credit risk can help analyze vast datasets to identify patterns and predict risks with greater accuracy. By processing information from various sources, including alternative data, AI models can provide real-time risk assessments, enabling lenders to make informed decisions.

2. Machine Learning Models for Credit Scoring:

Machine learning models, such as neural networks and decision trees, can handle complex, non-linear relationships within data, enhancing the precision of credit scoring. These models continuously adapt to new information, improving their predictive capabilities over time.

Industry-Specific Credit Assessment

Tailoring company risk assessment approaches to specific industries is crucial for accurate evaluations.

1. Tailoring Risk Evaluation for Different Sectors:

Different industries present unique risk profiles. For example, the technology sector may experience rapid growth but also face high volatility, while the manufacturing sector might have more stable cash flows but higher capital expenditures. By customizing risk assessment models to account for industry-specific factors, lenders can achieve more accurate evaluations.

2. SME Credit Assessment Challenges:

Small and medium-sized enterprises (SMEs) often lack extensive credit histories, making traditional credit assessments challenging. Incorporating alternative data and industry-specific metrics can provide a more comprehensive view of an SME’s creditworthiness. For instance, analyzing supply chain relationships, contract histories, and even online reviews can offer valuable insights into an SME’s financial health and operational stability.

Regulatory Compliance and Risk Mitigation

Adhering to regulatory standards is essential in credit risk assessment to ensure financial stability and consumer protection.

1. Basel Norms & IFRS 9 Impact:

Frameworks like the Basel Accords and International Financial Reporting Standard (IFRS) 9 set guidelines for risk management and financial reporting. Compliance with these standards requires robust credit risk assessment processes. For example, IFRS 9 mandates the use of forward-looking information in estimating credit losses.

2. Ensuring Compliance with Banking Guidelines:

Financial institutions must implement credit risk assessment tools and methodologies that align with regulatory expectations. This includes maintaining transparency in credit decisions, ensuring data privacy, and managing model risk.

The future of credit risk assessment lies in embracing advanced techniques that provide a more accurate evaluation of creditworthiness. By integrating alternative data sources, leveraging AI and machine learning, tailoring assessments to specific industries, and adhering to regulatory standards, financial institutions can enhance their risk evaluation processes.

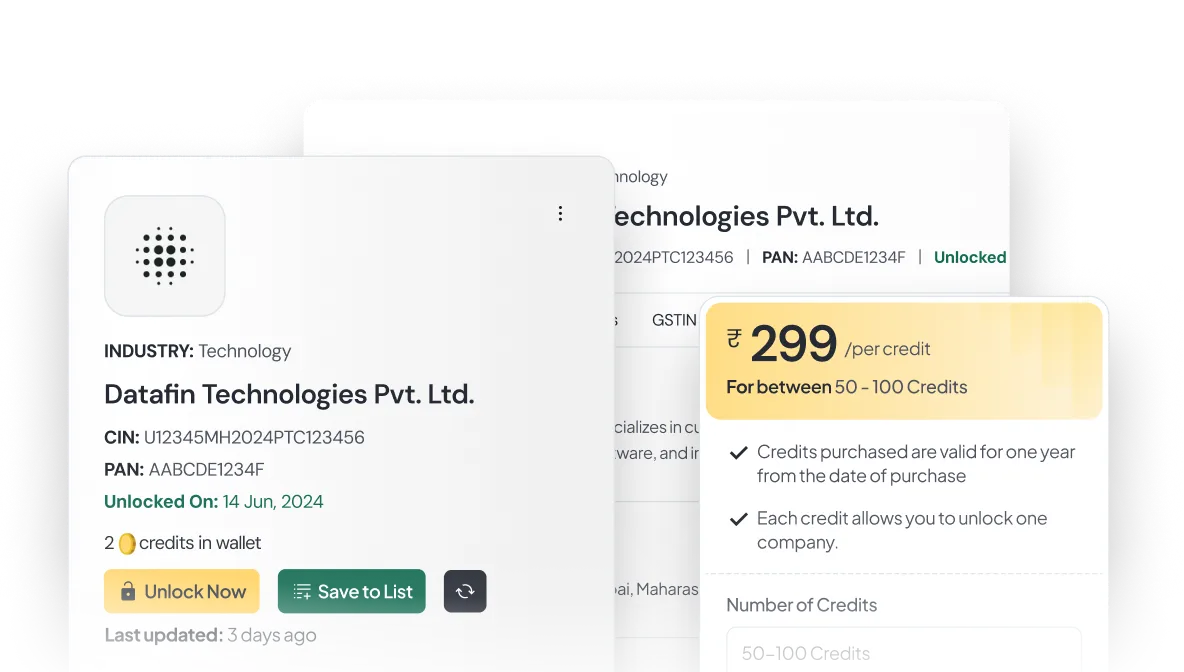

Access Financial Reports of Companies in India with Probe42

Probe42 is designed to streamline accessing information on over 20 Lakh registered companies that are active in India. We collect data from 740+ validated public domain sources for the most up-to-date information. This data is cleaned using fine-tuned algorithms and QA experts to make sure it is verified. Finally, we curate this highly accurate data for optimal presentation and seamless end-usage so you can get quick access without having to decipher it.

One of the key features of Probe42 is its ability to provide easy access to detailed current & historical company financial statements and reports. With Probe42, users can efficiently retrieve financial data on registered companies, including balance sheets, profit and loss statements, and cash flow statements. Gain valuable information and insights for making informed business decisions and conducting due diligence. Learn more about the many benefits of Probe42 at https://probe42.in/products/banking.html

Frequently Asked Questions (FAQs)

1. How do alternative data sources enhance credit risk assessment?

Traditional credit assessment primarily relies on credit scores and financial statements. However, incorporating alternative data—such as social media activity, transactional patterns, utility payments, and supplier relationships provides a more comprehensive evaluation of a borrower’s financial health. These insights help lenders assess creditworthiness more accurately, particularly for individuals and businesses with limited credit history.

2. What role does artificial intelligence play in modern credit risk evaluation?

AI and machine learning have significantly enhanced credit risk assessment by analyzing vast amounts of structured and unstructured data in real time. Predictive analytics models detect patterns in borrower behavior, assess risk probabilities, and identify early warning signs of financial distress. Machine learning-driven credit scoring adapts to new data over time, improving the precision of risk assessments and reducing manual processing biases.

3. Why is industry-specific credit assessment critical for financial institutions?

Credit risk varies across industries due to sector-specific financial structures, cash flow patterns, and economic cycles. For instance, technology firms may exhibit high growth but also volatility, while manufacturing businesses typically have capital-intensive operations with steadier cash flows. Tailoring credit assessment models to industry-specific risk factors enables financial institutions to make more informed lending decisions and mitigate sector-related risks effectively.

Latest News, Analysis & Trends

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

You can access data on a wide variety of Indian companies, including startups, MSMEs, and large corporations across sectors like technology, manufacturing, retail, and more.

Access Reliable Financial Data Instantly. Explore in-depth reports, track industry trends, and gain a competitive edge. Start now and transform your business strategy with data you can trust.

Get Started Now!